ISLAMABAD, Feb 9 (FD): The Pakistani authorities are expecting the International Monetray Fund (IMF) to share the draft memorandum of economic and financial policies (MEFP) with them today despite differences over external financing needs and power sector losses, reported The News.

Pakistan and the IMF were scheduled to hold parleys from January 31 to February 9, 2023 for making efforts to strike a staff-level agreement for the completion of the ninth review and release of the $1 billion tranche under the $6.5 billion Extended Fund Facility (EFF) signed by the Pakistan Tehreek-e-Insaf government in 2019.

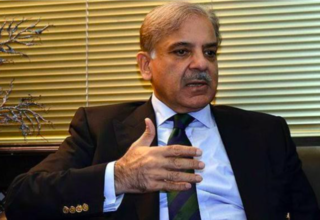

The Shehbaz Sharif-led government is in a Catch-22 situation due to tough conditions set by the lender and the political cost of these measures in an election year.

Prime Minister Shehbaz — while addressing the Azad Jammu and Kashmir Legislative Assembly in Muzaffarabad on Sunday — said that the “country is facing substantial financial challenges”, with the IMF “combing every book” and reviewing “everything” and “every subsidy” during the ongoing negotiations over the ninth review of the $6.5 billion loan programme.

Change in IMF strategy

Keeping the last reviews in view, both sides took much time for striking a staff-level agreement even after getting the draft MEFP document and nine tables. But, according to the Pakistani authorities, now the IMF mission had changed its working style — they will finalise the agreement first and then share the MEFP.

According to The News, if consensus cannot be developed today, the IMF mission might extend its stay or announce continuing parleys through online meetings from Washington DC.

Nathan Porter meets Ishaq Dar

On Wednesday, IMF Mission Chief Nathan Porter held a one-on-one meeting with Minister for Finance Ishaq Dar at the PM House.

According to a finance ministry statement issued late in the evening, talks with the IMF continued on Wednesday and focused on the fiscal table, financing, etc.

“There is a broad consensus on the reform actions and measures. The mission chief also called on the finance minister and briefed him about the talks,” the statement said adding that the IMF mission was working on putting it all together and would finalise the MEFP.

External inflows

Sources said the IMF had raised doubts about the shrinking dollar inflows, so without securing confirmation from all avenues of multilateral, bilateral, and commercial banks, the Fund delegation could not fulfil the gross external financing needs of $9 billion to $12 billion without securing confirmation.

This level of external financing is required in the remaining period of five months till June 30, 2023, if the reserves held by the SBP remained at around $3 billion.

However, if the country requires to build up foreign currency reserves of more than $3 billion, it will have to further increase dollar inflows. So, the path of securing much higher dollar inflows is the most difficult thing to do in a difficult environment.

The IMF expressed its unease over the projections made by the Ministry of Finance over external financing inflows from multilateral, bilateral creditors and in the shape of commercial loans.

The government had shown $2 billion additional deposits from Saudi Arabia, $1 billion from the UAE and commercial loans of $3.6 billion.

The World Bank programme loans and AIIB co-financing is also placed in the danger zone. Since the period of re-financing is over, the government will have to negotiate fresh terms and conditions for obtaining commercial loans keeping in view worsened credit ratings and increased default risks. If gross external financing needs are not fulfilled, the country’s foreign exchange reserves cannot be increased up to the desired mark.

The country’s short-term risk of default will continue to persist so the IMF does not want to share the blame for this in such a precarious position.

PM okays proposals

Meanwhile, Dr Aisha Ghaus told reporters that PM Shehbaz Sharif had given clearance for the measures required to revive the IMF programme.

She said that the government would protect the common citizens while the affluent class must pay the price of higher electricity consumption.

The minister said that both sides were nearing to clarity and hoped that the MEFP would be shared soon and agreement would be struck within the envisaged timeframe.