ISLAMABAD, July 21(ABC): As Pakistan awaits the final nod from the International Monetary Fund’s (IMF) Executive Board, the global lender is looking to assess Saudi Arabia’s commitment to financing Pakistan before disbursing fresh funds, reported, citing people familiar with the matter.

The publication stated that the Washington-based lender wants to ensure that Saudi Arabia will follow through with as much as $4 billion in funding to Pakistan to ensure Islamabad does not have a funding gap after the IMF loan.

The people familiar with this matter told that the transfer could include special drawing rights.

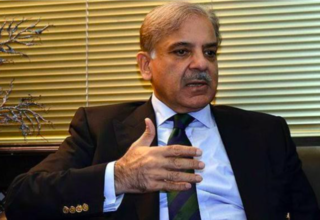

With the current economic situation in Pakistan, this matter has become crucial as the amount to be received from the IMF would be insufficient for Prime Minister Shehbaz Sharif-led government to protect the country from defaulting.

Pakistan’s rupee nosedived by a whopping Rs2.99 in a single day to hit an all-time low at Rs224.92 against the dollar in the interbank market today, while the Pakistan Stock Exchange (PSX) also traded between hope and despair as investors awaited a clear direction.

Moreover, bonds are sinking as the financing woes coupled with renewed political uncertainty roil the country.

The Fund is in discussion with a country about the expected disburses worth two billion special drawing rights (SDR) — supplementary foreign exchange reserve assets defined and maintained by the IMF — ($2.6 billion), Federal Minister for Finance and Revenue Miftah Ismail said during a briefing on July 20 without naming it.

It should be noted that Pakistan needs at least $41 billion in the next 12 months to fund debt repayments and boost foreign exchange reserves, which analyst Saad Khan from IGI Securities Limited anticipates will be met but only barely.

Pakistan secured a staff-level agreement with the IMF last week to revive its bailout package. If there’s a risk of default, the IMF’s board may not approve the release of the cash.